UPDATE: Useful review of music video trends in 2918, including the return of mega-budgets for a handful of elite artists:

Drake’s mates and Taylor Swift’s cosplay: exploring the 2018 music video

https://www.theguardian.com/music/2018/may/19/drakes-mates-and-taylor-swifts-cosplay-exploring-the-2018-music-video?CMP=Share_AndroidApp_Copy_to_clipboard

I was looking for some info on the 1D GCSE exam case study but spotted a number of great articles on here. So here's a few pointers based on the site.

You can find a bullet list I previously did summing up some key music industry points (with many links to posts) here.

AS CDS DISAPPEAR TOURS ARE JUST THE TICKET: 1D EXAMPLE

A

point I make many, many times: the traditional music industry model has

been through disruption from digitisation (though it hasn't rebalanced

the competition in favour of Indies; see Anita Elberse's fascinating

analysis of how big 3 acts utterly dominate Amazon sales, making the

'long tail theory' seem absurd), so labels are looking for new revenue

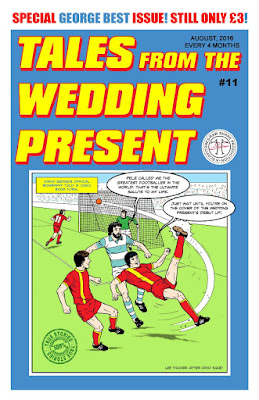

sources. Merchandise is a key factor - when I went to see The Wedding

Present (UK Indie band) in Luxembourg last year, I got to chat to the

singer after the gig, who was at the merch stall signing his own comic

book range alongside the usual tee-shirts etc.

A

point I make many, many times: the traditional music industry model has

been through disruption from digitisation (though it hasn't rebalanced

the competition in favour of Indies; see Anita Elberse's fascinating

analysis of how big 3 acts utterly dominate Amazon sales, making the

'long tail theory' seem absurd), so labels are looking for new revenue

sources. Merchandise is a key factor - when I went to see The Wedding

Present (UK Indie band) in Luxembourg last year, I got to chat to the

singer after the gig, who was at the merch stall signing his own comic

book range alongside the usual tee-shirts etc.The likes of 1D aren't going to do that. They did sell VIP packages for gigs - something else I saw at a Depeche Mode gig, with multiple tiers including a basic that simply allowed you into the venue earlier to hear the soundcheck. I've blogged on Taylor Swift and Katy b Perry doing this, with fans paying a lot for a selfie opportunity. [meet-and-greets post]

The basic breakdown is clear though - most major artists (Indies too) will gain more from tours than album sales. Even combined with streaming (which is now bigger than physical sales and download sales combined) that remains the case. Getting onto TV ads, film/game OSTs are also potentially lucrative.

Here's that 1D breakdown:

One Direction’s latest album, Made In The AM, was a big success, selling just over 1m copies across the UK and US in 2015 after being released in November.

Judging by the 2014 calendar year performance of its predecessor, Four, it’s a fair bet that the newer album sold around 3.2m units across the world before last year was finished.

At an average US sale price, you’d therefore expect it to have grossed somewhere around $36m – although that is without streaming revenue.

Being generous, adding in streaming and single sales, let’s round it up to $50m.

The fact that this total is approximately one sixth of the size of 1D’s 2015 tour gross probably tells its own story.

The fact it’s less than half of the band’s secondary ticketing gross alone tells another.

Remind us again: what’s an artist’s core product – and what’s their ‘ancillary income’? [article]

GOOGLE IS COMING...

YouTube Red is its current $9.99/month option, offering:

- no ads

- video downloads

- exclusive content (which they're expanding)

- the ability to continue playing YouTube when switching to other apps

The clear categorization of Youtube Red as a music-first platform comes at an interesting juncture: YouTube is widely expected to reveal a new Spotify rival, currently codenamed Remix, in the coming weeks.YouTube Red is only available in 5 territories currently, but rights deals Google/Alphabet have signed with the big 3 mean they intend a 100+ country rollout of this new (just rebranded YT Red?) service.

‘Remix’ looks likely to supersede Google Play Music, and has reportedly been made possible by YouTube’s recent deal renewals with the likes of Universal, Sony and Warner. [article]

UGC TAKING A HIT ON YOUTUBE

| A new YT channel with VEVO branding dumped? |

Having just looked, it appears this change is in place as of Feb 2018: the 1D channel is mainly Vevo content, but the Vevo branding is gone (I don't see the music note in place of the tick though).

That seems an odd choice for YT, but presumably the majors insisted on this before signing up.

This switch seems likely to have formed a part of recent licensing negotiations with the two parties who together make up Vevo’s majority owners: Universal Music Group and Sony Music Entertainment, who both struck new deals with YouTube before the end of last year. [article]MUSIC IS STILL KING ON YOUTUBE (ISH)

Gaming is a key content driver for YT, but music is still central to its monetisation and general use - including the common example of convergence of people using a connected TV (or just a phone linked to speakers) as their hi-fi.

Five of the world’s 15 most-subscribed-to YouTube channels right now are Vevo channels.

Justin Bieber’s Vevo destination (JustinBieberVevo) is the world’s second biggest YouTube channel with 33.6m subscribers, while Taylor Swift’s Vevo hub (TaylorSwiftVevo) is YouTube’s fifth biggest global channel with 27.3m subs. [article]

|

| Infographic from Forbes. |

THEORY TIP: I have posted guides on web 2.0 theorists before. One of these, John McMuria, a sceptic, argues that this brave new world is remarkably like the old (analogue or early web) one: its dominated by giant multinational conglomerates. He was writing when Google and FB where large but not quite the extraordinarily powerful corporations they are now; his point was that the same big 6 (film) or big 3 (music), for example, are dominating the online monetising and consumption of media content.

YOUTUBE EXPANDING ORIGINAL CONTENT WITH $200K MARKETING GRANTS

|

| Taking the YT shilling (source). |

YouTube has, in recent weeks, reportedly given a handful of artists marketing budgets of around $200,000 to produce videos and take out billboard advertising campaigns.SALES SAIL AWAY BUT UMG POCKET $17.5M EVERY DAY

And some of these musicians, say Bloomberg’s sources, are being asked to guarantee that they will not openly talk down the amount of cash YouTube pays out to copyright holders.

The news comes little more than 18 months after over 180 prominent artists – including Sir Paul McCartney, Taylor Swift and Beck – signed a petition criticizing the ‘safe harbor’ provisions found in the US Digital Millennium Copyright Act (DMCA), which allow platforms such as YouTube protection from legal liability for copyright infringement taking place on its platform. [article]

Physical sales are boosted by the high-priced vinyl 'boom', but this big % growth but is from a low base and nowhere enough to compensate for fast-sinking CD sales, while the digital download market is widely predicted to disappear within a few years, as streaming replaces ownership as the default 'consumer' choice.

Despite all the gloomy analysis, UMG (Universal Music Group, 1 of the Big 3 with Sony and Warner) are pocketing an incredible $17.5m every day on average, over $6bn annually (2017 figures).

Its streaming which explains the rising figures when the 'disruption' of digitisation is widely assumed to be catastrophic for the music industry.

This growth was propelled forward by recorded music streaming revenues, which totalled €1.97bn ($2.2bn) in 2017.

That was up 35.4% year-on-year – despite the major striking a licensing deal with Spotify in 2017 which saw a small reduction in the margin it took from every dollar spent on the service. [article]

I've blogged from other sources many times - the music industry tag is a big one on the tag cloud you can use to find more - but these are a few useful points I saw evidenced on this site alone. A good one to dip into!

No comments:

Post a Comment